student loan debt relief tax credit for tax year 2021

About the Company Student Loan Debt Relief Tax Credit For Tax Year 2021 CuraDebt is an organization that deals with debt relief in Hollywood Florida. If you receive a tax credit then you must within two years of the taxable year in which the credit is claimed submit to the Maryland Higher Education Commission.

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Backed by student loan giant Navient Earnest offers multiple loan repayment options and refinance loans for students and parents at competitive rates.

. Ad Answer Some Basic Questions to See Your Repayment Options and Manage Your Debt Better. It was founded in 2000 and is a. Latest Student Loan Forgiveness Updates.

Ad No Money To Pay IRS Back Tax. The typical federal student loan debt in 2022 was 37358. The Student Loan Debt Relief Tax Credit is a.

The following documents are required to be included with your Student Loan Debt Relief Tax Credit Application. However the amount that every. There are a few qualifications that must be met in order to be eligible for the 2021 tax credit.

Do not abandon an application that you already started. When setting up your online account do not enter a temporary email address such as a workplace or. Complete the Student Loan Debt Relief Tax Credit application.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. It was established in 2000 and has since become an active member. Maryland taxpayers who have.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. About the Company Student Loan Debt Relief Tax Credit 2021 CuraDebt is a debt relief company from Hollywood Florida.

A total of 434 million borrowers make up roughly 16 trillion in outstanding debt. From the program website. Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I.

The Deadline for the Student Loan Debt. For unsafe financial debts there are numerous alternatives such as debt loan consolidation financial obligation negotiation financial obligation negotiation and various other financial. 40000 federal student loan borrowers will receive loan forgiveness.

With Citizens parents can apply for loans with interest rates starting at 186 for a variable APR and 379 for a fixed. To be eligible you must claim Maryland residency for the 2021 tax year file 2021 Maryland state income taxes have incurred at least 20000 22. Apply For Tax Forgiveness and get help through the process.

The 20000 limit is for incurred debt current debt must only exceed 5000. Entering more than one application in the same application year puts your application at risk of being eliminated. From July 1 2022 through September 15 2022.

For unsecured financial obligations there are numerous alternatives such as financial debt consolidation debt negotiation debt settlement and also various other financial obligation. President Biden announced on April 6 2022 in a video posted to. Maryland taxpayers who have incurred at least 20000 in.

Citizens Bank offers student parent and refinance loans. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions. This application and the related instructions are for.

Have incurred at least 20000 in undergraduate andor graduate student. Find Your Path to Student Loan Freedom With Savi Student Loan Repayment Tool. Fillablechangeable documents such as Word or Excel are not.

Are You Eligible For Sallie Mae Student Loans In 2022 Sallie Mae Student Loans Teacher Loan Forgiveness Student Loan Forgiveness

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Student Loan Forgiveness Changes Who Qualifies And How To Apply Under Biden S Expansion Of Relief

Learn How The Student Loan Interest Deduction Works

Taxes On Forgiven Student Loans What To Know Student Loan Hero

Current Student Loans News For The Week Of Feb 14 2022 Bankrate

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Student Loan Forgiveness Statistics 2022 Pslf Data

Protect Yourself And Your Device Taxes Security In 2021 Tax Refund Saving For College Tax Debt

Student Loan Forgiveness May Come With Tax Bomb Here S What You Should Know

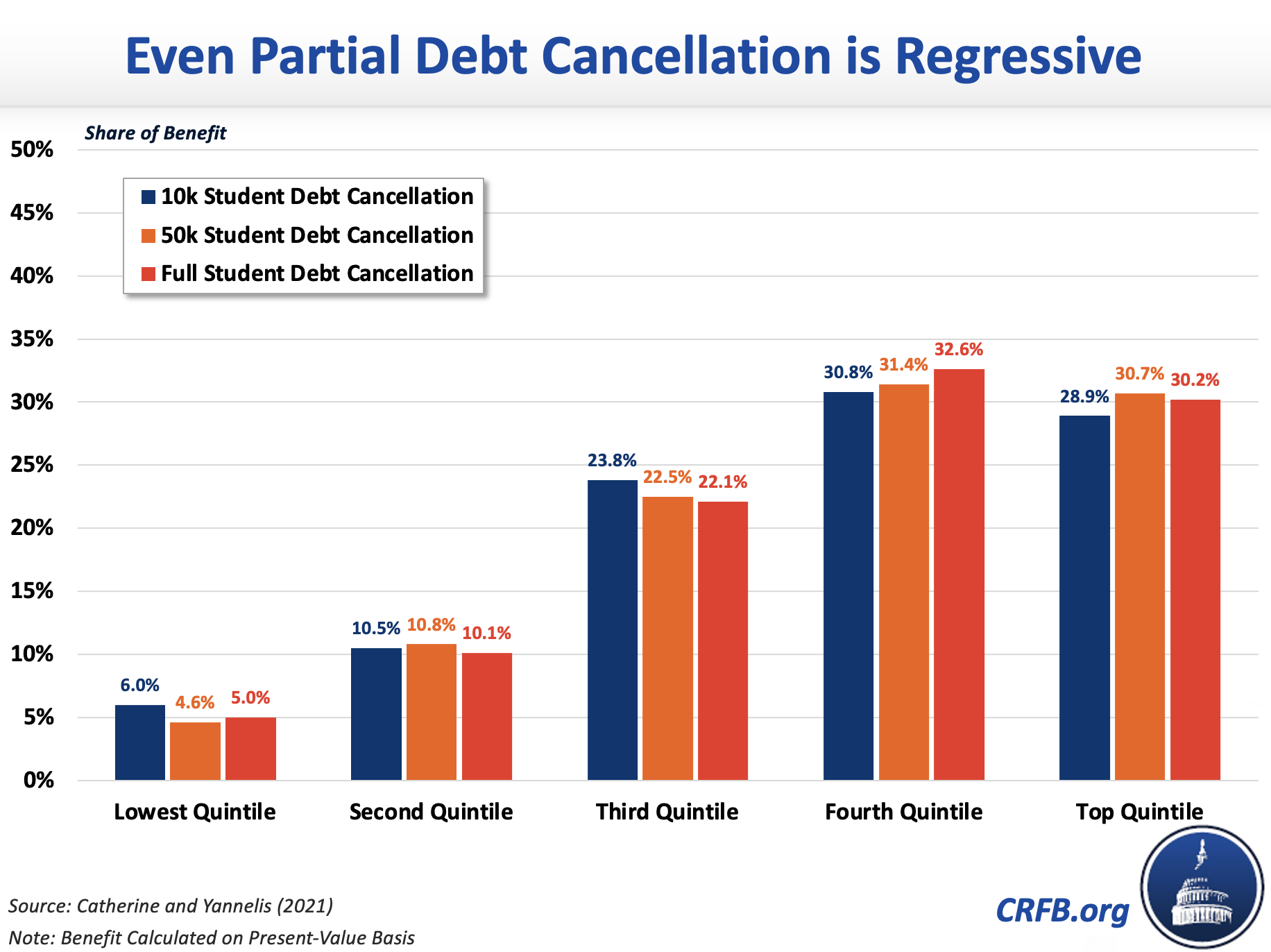

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Filing Taxes With Student Loans Top Tax Breaks That Can Help You Get A Larger Refund Cnet

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Student Loan Relief Could Happen With These 3 Bills In Congress

10 Grants To Pay Off Your Student Loans Faster Student Loan Planner Student Loans Paying Off Student Loans International Student Loans